Summary

->The S&P 500 returned -4.24% in august compared to

the average august return of 0.45%. we now head into September ,

historically worst month for equities .

-> The US dollar index made 20 year highs on Thursday , and treasury

yields spiked accordingly.

-> short term holder cost basis , Mayer multiple , and Puell Multiple indicate

that bitcoin ids likely near bottom.

-> A record low of 6.1% of the circulating Bitcoin supply has moved in the last month.

-> mining difficulty increases by over 9% as bitcoin’s hash rate rips back with vengeance.

General Market Update

-> It’s been another fairly brutal week of price action and we have lots to discuss here today. One of the more discussed topics this week has been uranium.

The visual above shows us the performance of several energy commodities over the last week. Clearly , something is going on in the nuclear energy market.

Crypto Exposed Equities:

->Unsurprisingly, it has been another tough week of price action

among crypto - exposed equities.

Bitcoin Technical analysis

It’s been a pretty quiet week for spot Bitcoin ,At the moment , it looks like

BTC is putting in another Bearish consolidation .

-> By far the buyers are able to defend this ~ $19,600 level

A break below this level would likely end in a test of support

at $18,600, or potentially the YTD lows of $17,600.

-> The declining 10- day EMA hanging overhead (green line )

this has been a place for sellers to step in over the last 3 weeks .

Bitcoin On chain and Derivatives

-> The Short term cost basis (STH) Cost Basis and Long Term

Holder (LTH) Cost Basis are on the collision course . Currency,

STH Cost Basis sits at $25k and LTH is $23k.

-> Most of the time : STH Cost Basis > LTH cost basis .This

is because new ,market participants (STH) are buying at much

higher prices relative to LTH.

-> There are two reasons for this. First , as the price goes down

from the all time high ,STH are able to average in at lower prices

while LTH are still buying at a price that is high relative to where they bought previously. Second, each each bull run breeds a new cohort of convicted Bitcoiners .in other words , STH ages into LTH which increases the LTH cost basis.

THE Puell multiple , a frequency cited valuation metric , has

re-entered the value zone.

-> Coined and created by David Puell of Ark Invest, the Puell

Multiple measures the daily issuance value of bitcoin (in USD) relative

to the 365- day moving average of the daily issuance value

->The Myer Multiple measures the range between the bitcoin

price and the 200- day moving average . When Mayer Multiple =1,

Price=200- day moving average .

-> The 200- day moving average is widely accepted as a board based

long-term trend indicator and Mayer Multiple is currently at a level only only seen during Bitcoin price bottoms.

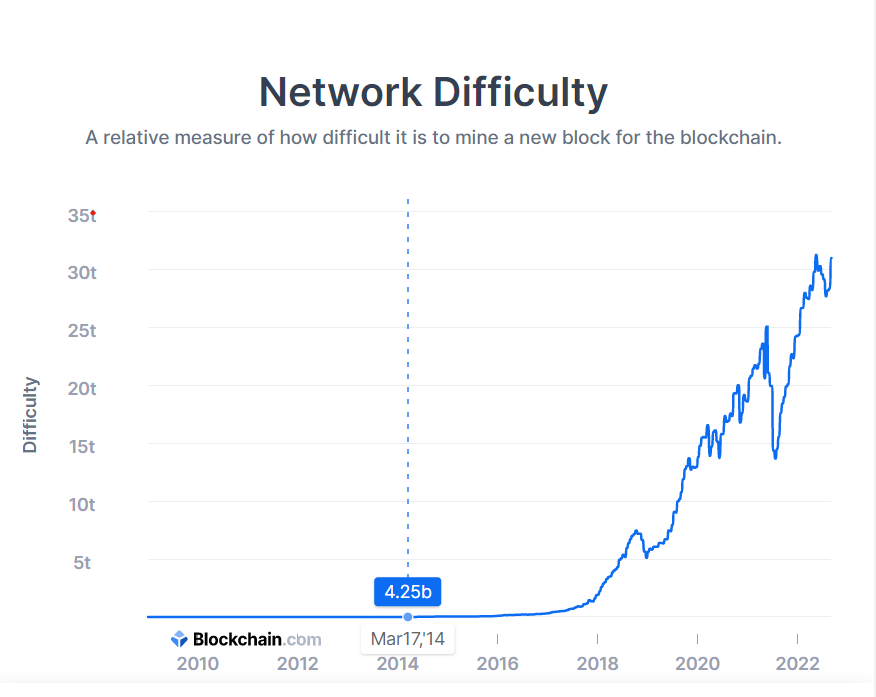

9.3% Increasing in Mining Difficulty

-> Miners that are capitulated their rigs this summer , sold them to buyers that were better better capitalized and likely had access to cheaper electricity. Weak miners sell more Bitcoin than strong miners , and a fair amount of ASICs shifted hands during the capitulation this summer .

-> NEW ASICs(XP) are likely beginning to get shipped and plugged in

-> As you can see on both the difficulty chart and the hash rate chart , more rigs are being turned on and mining difficulty is on its way back to all- time highs.

All content is for informational purposes only. This Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Great work brother 👍