Summary:

→ A weak Eurozone PMI report triggered a cascading breakdown for the pound, euro, and EU/UK bonds.

The Bank of England was ultimately squeezed by this data and decided to revert back to expansionary (inflationary) monetary policy despite being in one of the most inflationary environments in modern history.

Mortgage rates in the US hit 16 year highs this week, which comes alongside July’s Case-Shiller numbers which showed a decline in housing prices not seen in over 10 years.

The dollar is cooling off this week which could provide some wiggle room for Treasuries and equities to get a bounce heading into next week.

STH RP has crossed below LTH RP which signals an incredible opportunity that has previously occurred only at bear market bottoms.

A spike in realized losses provides evidence that the worst BTC capitulation may be over.

Multiple on-chain metrics show that long term holders have accumulated a large percentage of the BTC supply, and they aren’t letting go.

Bitcoin Mining Difficulty had a slight adjustment down after making new all-time highs in mid-September.

Bitcoin Energy Gravity, which estimates the mean breakeven electricity cost for modern mining rigs, sits at $0.09 per kWh, which historically has been a good buying opportunity.

General Market Update:

Following last week's fireworks, it has felt like a fairly quiet week across the general market. But there certainly were some things for investors to look out for.

Some of the biggest business news stories came from our friends across the pond in the United Kingdom.

On Monday, we saw a severe breakdown of the British pound against the US dollar. This came alongside news of severely weakening economic conditions across the UK and EU.

S&P Global Flash Eurozone Manufacturing PMI(source)

S&P Global Flash Eurozone Manufacturing PMI (Source)

The eurozone PMI, a measure of economic purchasing conditions, fell fairly significantly to 48.2 for the month of September and has been a major catalyst for the breakdown we’re seeing across the UK and EU.

If you don’t recall, the Purchasing Managers’ Index (PMI) is a measure of the sentiment of purchasing managers across the manufacturing industry. When PMI is rising, generally economic conditions such as demand and liquidity are improving.

A declining PMI environment often coincides with contractions in economic activity also known as the recessionary period of the Short-Term Debt Cycle (or 5-10 year business cycle).

Following Monday’s Eurozone PMI report, bond yields are spiking in the UK and EU and we saw a major decline of the pound and euro against the dollar.

In aggregate, global bonds are on track for their worst year since 1949.

Then on Wednesday, the Bank of England announced that they will be the first to do what many have been waiting for, the good old fashioned pivot.

With inflation pressuring nearly all facets of the economy, the BoE has now decided that a pivot back to quantitative easing will restore stability to their currency and economy.

This would be hilarious if the results of their decision weren’t so dire. They are quite literally attempting to fight fire with gasoline, or petrol, as our English friends might say.

Broadly speaking, the overly aggressive QE cycle that the US’ Federal Reserve undertook is what got us into this mess.

And yes, of course there are other inflationary and negative macro forces out there that played a role, but it is likely that the MAJORITY of the inflation we are seeing was self inflicted.

QE is inherently inflationary, you are creating currency in order to inject liquidity into the fixed-income market. The concern from the English should now be if the BoE will push them into hyper-inflation.

Many are calling for the US to do the same, or are at least predicting that the US will do the same. Personally, I believe that the Fed is likely not to follow England anytime soon, or at least until we can fully observe how their prices and economy react to the news.

As of now, we’ve seen a jump in the pound and UK bond prices since the pivot announcement. As you can see above, GILS, an ETF tracking the performance of UK government bonds, which jumped 6.80% yesterday. This was GILS largest single day performance of at least the last 10 years.

To put it into perspective, GILS was up about 6% in all of 2020.

Back in the US, mortgage rates are continuing to scream higher as the effects of higher market rates, declining demand, and consumer fear take a hold on the economy.

US Average 30-Year Fixed Mortgage Rate (FRED)

In the month of July, the index declined by 33bps. This marked the largest monthly decline in home prices since 2011, around the bottom of the decline triggered in 2008.

With mortgage rates now up nearly 1.5% since July, we would expect to see a continued decline in the C-S Index for the months of August and September.

Moving onto the stock market, we saw a relatively flat week turn into a bloody Thursday with the Nasdaq closing at -2.84%, it’s worst day in 2 whole weeks!

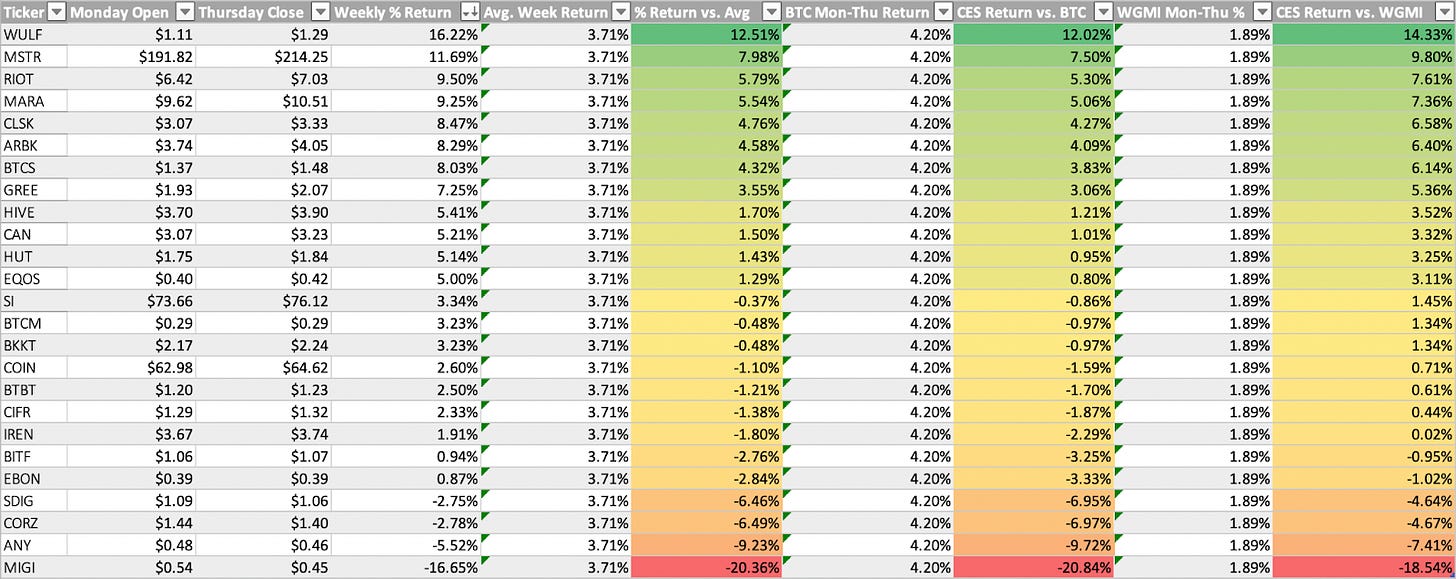

Crypto-Exposed Equities

This week was a fairly quiet one for crypto-exposed equities. For the most part, they drifted slightly higher and formed what appears to be a bear flag.

Per usual, there are a few names who have stood to me this week from a price structure perspective.

Those names are WULF, CAN, MSTR, and RIOT this week

Above, as always, is the table comparing the Monday-Thursday performance of crypto-exposed equities to that of BTC and WGMI.

Bitcoin Technical Analysis

It’s been an especially volatile week for Bitcoin price action.

BTCUSD 1D (Tradingview)

On Tuesday, we saw BTC attempt to break above its current range but ultimately it formed a downside reversal.

Wednesday and Thursday were the opposite in that BTC attempted to break lower but buyers were able to support price.

We’re starting to see BTC curl up here, as buyers around $18.5K have been able to support higher bids for the time being. A few areas to note are the declining 50-day SMA at $20.6K and the upper trendline drawn above at about $21.5K.

It’s very likely that this current uptick is setting up for a break to the downside. At this point, our fundamental thesis is unchanged in that BTC is more likely to retest its YTD lows than not.

But that doesn’t mean that we are expecting a straight-down move, in fact we would expect to see this sort of short, jumpy rally, as we discussed in the equity section of this newsletter last week.

While, of course, we could very well be wrong and perhaps the bottom is in, the cyclical weakness of risk assets in a period where yields and the dollar are rising together makes us believe that we likely have lower prices to come

Bitcoin On-chain and Derivatives

Short Term Holder Realized Price has finally crossed below Long Term Holder Realized Price.

All previous occurrences of this crossover have served as incredible market entry points.

This means that short term holders, in aggregate, now have a lower cost basis than long term holders. This results as a combination of STHs buying on the way down, lowering their cost basis, as well as STHs aging into the LTH cohort creating upwards pressure on the aggregate LTH cost basis.

Take note of how both cohorts have a cost basis greater than the current BTC price.

Long Term Holders tend to not sell their BTC, and they most certainly do not sell at a loss.

HODL Waves show the distribution of the Bitcoin supply to different cohorts of HODLers. Over 60% of the supply has not moved in one or more years.

This level of unwillingness to sell by long term holders is similar to what has occurred during past bear markets. This much supply being in the hands of long term holders, whose cost basis, as previously mentioned, is, in aggregate, underwater, provides evidence to the thesis that the worst of the bear market is likely over

Downward Difficulty Adjustment

Over two weeks ago, Bitcoin mining difficulty adjusted to a new all-time high. The previous all-time high was set in May of 2022. Since this peak, mining difficulty fell 11.4% and as of mid-September it completely recovered due to new generation machines coming online, less power curtailment, and inefficient miners selling their rigs and getting them plugged back in by a more efficient miner.

The downward difficulty adjustment that occurred this week likely won’t start a trend of downward adjustments unless Bitcoin’s price makes new lows forcing another wave of miner capitulation. However, miners are rejoicing at this small adjustment as it does mean they now earn more BTC than a week ago

.

Many mining companies used the 2021 bull market to take on excessive leverage, which has, unfortunately, put them in a poor position to survive any prolonged bear market. The next mining difficulty adjustment, expected to come in the next 24-48 hours is expected to be negative.

As Warren Buffett once said, “be fearful when others are greedy, and greedy when others are fearful.” Some of the largest players are experiencing major hardships. Now is the time to average in by purchasing mining rigs and dollar cost averaging into BTC at a discount.

All content is for informational purposes only. This sskninja Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.