If you want to move tokens from one blockchain to another, you’ll likely need a blockchain bridge to allow those assets to travel.

One of the biggest problems of blockchain was the inability to work together. While fluid and somewhat efficient as single entities, each blockchain is limited by the walls of its own domain. Most often this can lead to high transaction costs and congestion.

Blockchain bridges solve this problem by enabling token transfers, smart contracts and data exchange, and other feedback and instructions between two independent platforms.

How Do Blockchain Bridges Work ?

Through a blockchain bridge, bitcoin users can transfer their coins to Ethereum and do with them what they otherwise could not on the bitcoin blockchain. That can include purchasing various Ethereum tokens or making low-fee payments.

They can be decentralized, centralized, or even hybrid. There are two ways bridges carry out asset transfer: wrapped assets or liquidity pool.

Liquidity Pool Method :

Some blockchain bridges, such as “Cross-Chain Bridge” and Synapse Protocol, adopt different approaches. They have liquidity pools for a wide array of assets. For instance, there are liquidity pools for WETH on BNB Chain, Polygon, and so on.

These liquidity pools serve as banks. For instance, when a user wants to bridge WETH from Polygon to ETH on Ethereum, Cross Chain Bridge allocates funds from their liquidity pool to send the user ETH in Ethereum.

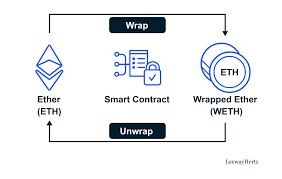

Wrapped Asset Method :{Encapsulation}

The wrapped asset method, also known as token wrapping, is a popular approach used by blockchain bridges to enable the transfer of assets between different blockchain networks.

Process of asset wrapping :

Asset Locking: To initiate the wrapped asset process, a user deposits their assets (e.g., cryptocurrencies, tokens) into a smart contract or custodial address on the source blockchain. These assets are locked or held in custody by the bridge.

Token Minting : Once the assets are locked, the bridge issues an equivalent amount of wrapped tokens on the target blockchain

Bridge Reserves: The bridge maintains reserves of the original assets on the source blockchain to ensure that there is always a backing for the wrapped tokens.

Cross-Chain Communication: The bridge monitors and facilitates the communication between the two blockchains to ensure the synchronization of the wrapped tokens and the locked assets.

Token Usage and Transfers: Once the wrapped tokens are minted, they can be freely transferred and used within the target blockchain's ecosystem. Users can trade, exchange, or utilize the wrapped tokens in decentralized applications (DApps) or smart contracts on the target blockchain.

Redeeming Wrapped Tokens: If a user wants to convert their wrapped tokens back into the original assets, they can initiate the redemption process. The user sends the wrapped tokens to a specific smart contract or custodial address on the target blockchain, and the bridge verifies the transaction. Once the verification is successful, the bridge releases an equivalent amount of the original assets to the user's designated address on the source blockchain.

Wrapped asset methods have been widely utilized for bridging assets between networks such as Ethereum, Binance Smart Chain, and other popular blockchain platforms.

Types Of Crypto Bridges:

Trusted Bridges: Trust-based bridges are fast and an economical option when you want to transfer a large amount of crypto, but the pool of reliable services is rather small. Venturing to the territory of less-known brands can increase risks, which makes it unattractive to smaller traders. Users need to give up control of their crypto assets.

Trustless Bridges: that intend to make users feel safer when transferring their coins. These solutions operate just like an actual blockchain with individual networks pitching in to validate transactions. If you’re worried about your coins falling in the wrong hands, using a trustless bridge will give you peace of mind in that regard. Trustless bridges operate using smart contracts and algorithms. Through smart contracts, trustless bridges enable users to remain in control of their funds.

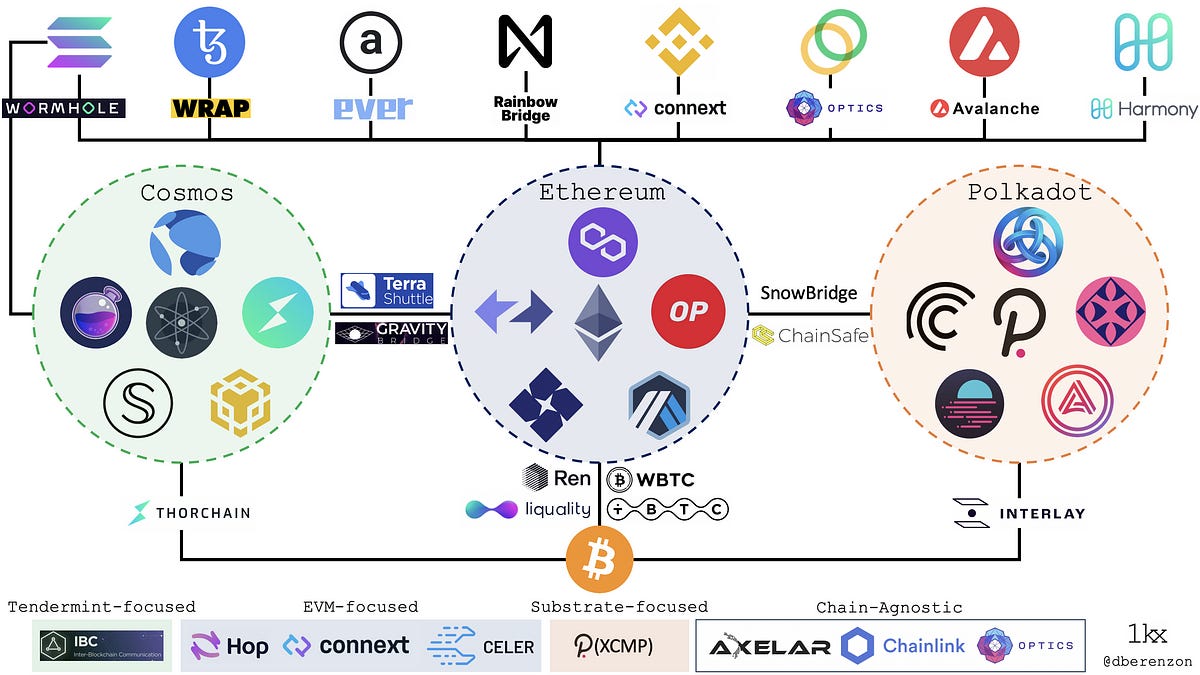

Commonly used bridges :

Token Bridge: A token bridge allows the transfer of tokens or assets from one blockchain to another. It typically involves locking the tokens on one blockchain and minting equivalent tokens on the target blockchain.

Cross-Chain Bridge: A cross-chain bridge enables communication and transfer of assets between two or more different blockchains. It establishes a connection between these blockchains, allowing for interoperability.

Decentralized Exchange (DEX) Bridge: DEX bridges enable the exchange of assets between different decentralized exchanges operating on separate blockchains. These bridges facilitate cross-chain trading and liquidity provision.

Oracle Bridge: An oracle bridge connects a blockchain network with external data sources, enabling the transfer of off-chain data onto the blockchain. Oracles provide real-world data to smart contracts, and the bridge ensures secure and reliable data transfer.

Smart Contract Bridge: This type of bridge allows smart contracts to interact and exchange information across different blockchain networks. It ensures compatibility and interoperability between disparate smart contract platforms.

Sidechain Bridge: Sidechains are parallel chains connected to the main blockchain, offering scalability and specialized functionality. A sidechain bridge allows assets and data to move between the main blockchain and the sidechain.

What are the biggest blockchain bridges?

According to DeFi Llama, there was $21.8 billion worth of crypto locked in bridges as of March 2022. The largest blockchain bridge is Wrapped Bitcoin, accounting for almost half of the bridge market, with $10.2 billion in total value locked (TVL).

Avalanche Bridge is the largest Ethereum bridge, with about $6 billion in TVL, followed by Polygon ($5 billion TVL) and the Fantom Anyswap Bridge ($4.2 billion TVL).

Bridge Use Cases :

1. Transfer Crypto To A Different Blockchain

Bridges come in handy whenever you want to transfer your crypto from one blockchain to another. If you bridge SOL, you will get SOL, just in a different form and on a different blockchain.

2. Exploring Various Ecosystem dApps

Every blockchain ecosystem has its unique dApps. You can bridge your asset from chain A to chain B to explore some dApps in chain B. If you’ve been using Aave on Ethereum Mainnet to lend USDT but the interest rate for lending USDT using Aave on Polygon is higher.

Risks Of Crypto Bridging :

Centralized Theft

Centralized crypto theft is inherent only to trusted bridges. The centralized authority controlling the bridge can unanimously steal users’ funds. Even though no founding team of any trusted bridge has rugged the users, it is possible.

Cloned Bridge Websites

DeFi is booming, and scammers now come up with cloned websites to defraud unsuspecting users. The fake cloned website looks like the actual bridge allowing scammers to steal crypto when a user deposits it for bridging.

On this note, always double-check against phishing to ensure you transfer funds to a genuine bridge application.

Smart Contract & Cybersecurity Attacks

Blockchain bridges have been the target of the most massive attacks in the blockchain world. Hackers have always focused on them due to their relatively high volume of funds. Research confirms that over $2.5 billion have been stolen from cross-chain bridges. This is a quick stat of how much hackers have stolen from some bridges:

Ronin Bridge — $522 million

Wormhole Hack — $320 million

Nomad Hack — $200 million

Multichain Bridge Hack — $3 million

Portal VS Multichain VS Poly Bridge :

Different Blockchain Bridges :

All content is for informational purposes only. This Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice.