EigenLayer : New Way For Restalking Ethereum

EigenLayer is a protocol built on Ethereum that introduces restaking, a new primitive in cryptoeconomic security. There are thousands of decentralized applications (DApps) currently built on top of Ethereum, and the ecosystem is constantly growing. However, not all applications are taking full advantage of the trust and security of Ethereum.

Actively validated services (AVS) such as sidechains based on new consensus protocols, data availability layers (DA), new virtual machines, oracles, and trusted execution environments, etc.This primitive enables the reuse of ETH on the consensus layer. Users that stake ETH natively or with a liquid staking token (LST) can opt-in to EigenLayer smart contracts to restake their ETH or LST and extend cryptoeconomic security to additional applications on the network to earn additional rewards.

EigenLayer has already captured over 175,000 ETH in Total Value Locked (TVL) This allows people who have already staked their Ethereum (ETH) or Liquid Staking Tokens to essentially double-down by restaking those assets.

EigenLayer enhances the security infrastructure across Ethereum services without requiring stakers to invest more capital. This is particularly beneficial for new dapps built on Ethereum. Instead of starting from scratch and building their network of trust, they can simply tap into EigenLayer and make use of the existing pool of stakers. This eliminates fragmentation and builds a more unified, secure ecosystem.

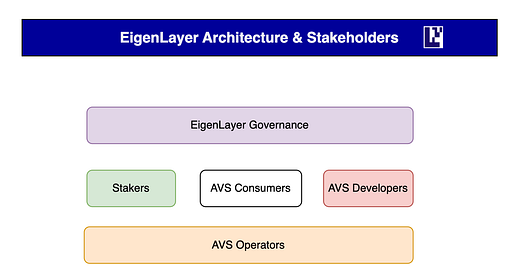

EigenLayer Architecture :

Working of EigenLayer:

Stake Your Assets: Initially, you'll need to visit the EigenLayer app to stake some ETH or LSTs like stETH, rETH, or cbETH in the Ethereum network.

Opt-In to EigenLayer: Once your assets are securely staked, you can activate the restaking function by opting into EigenLayer's specific smart contracts.

Secure Multiple Services: By restaking, you contribute to the security of multiple decentralized applications and services within Ethereum's ecosystem, yielding additional rewards.

Flexible Participation: The protocol allows simultaneous opt-ins to multiple security pools, reducing the capital entry barrier and enhancing system-wide trust levels.

Delegation and Operators: Future releases of EigenLayer will enable stakers to delegate their restaked assets to specific operators for more focused staking strategies.

Smart Contracts in Action: EigenLayer leverages a variety of contracts such as EigenPod, DelayedWithdrawalRouter, and StrategyManager to facilitate features like native restaking and delayed withdrawals.

Safety Measures: If you withdraw, EigenLayer imposes a 7-day hold period for your staked assets, adding a layer of security to the withdrawal process.

Need for EigenLayer :

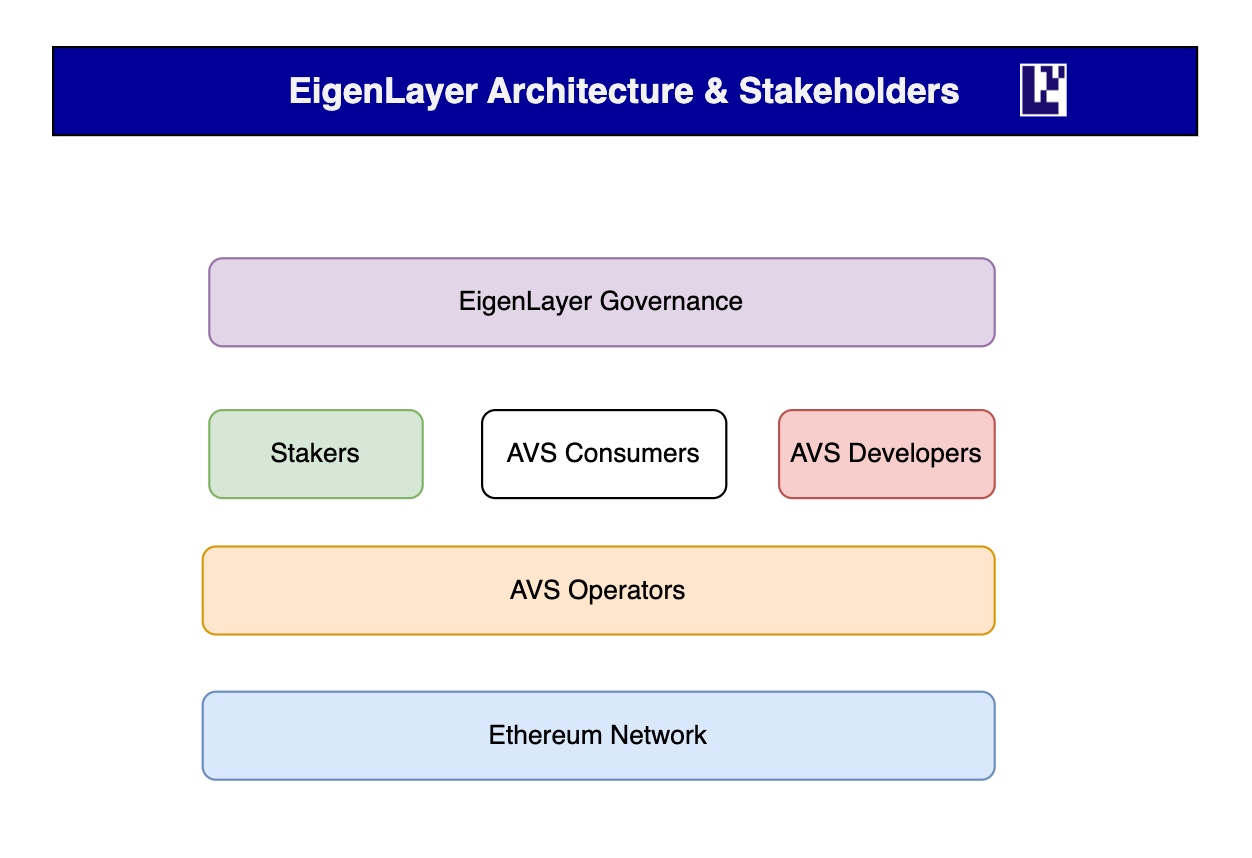

Blockchains are revolutionary because they have eliminated the need for trust between people & institutions. Instead of trusting a human for our daily interactions, we now trust a decentralized set of nodes. But developing such a network is often the most challenging part.

The Problem with other protocols lead to the invention of the layer

BTC : it can only do P2P $BTC transfers, it is an application-specific chain.

2 . ETH : To to build a new decentralized application, developers had to create an entirely new decentralized network of computers. Ethereum founders recognized this problem & created an EVM execution layer upon Ethereum's trust module. This enabled innovation on the application layer.evelopers can now make use of Ethereum's base trust layer and build innovative decentralized apps upon it. All of this without having to bootstrap a new network.

Ethereum's trust module consists of three components:

1. Trust network

2. Consensus

3. Execution layer

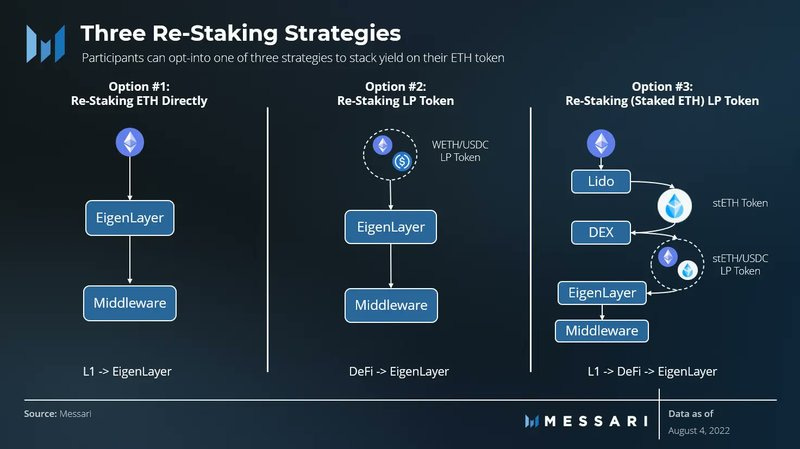

EigenLayer introduces 2 new concepts to extend Ethereum’s security to other systems and improve the efficiency of governance, namely re-staking and free-market governance.

EigenLayer can solve the problems of AVS ecosystems as mentioned above:

New AVSs can bootstrap economic security with existing Ethereum validators

Greater value accrual by allowing ETH stakers to earn additional revenue through validating for various AVSs

Capital cost for using Ethereum’s security enhancements are amortized across multiple AVSs

Drastically increases the cost-of-corruption since trust is now aggregated

Slashing Analysis:

Slashing is an important mechanism that imposes a high cost of corruption, and therefore ensures strong cryptoeconomic security. Since stakers point their withdrawal authority towards EigenLayer contracts, any malicious actor that withdraws their ETH on the Ethereum base layer will have their ETH slashed by the on-chain contract of the AVS.

Merge mining vs Restaking :

How EigenLayer Secures Protocols on Ethereum:

The protocols can integrate EigenLayer to leverage Ethereum's underlying security by ‘renting’ it. This is achieved by allowing ETH stakers to restake their ETH to secure these protocols, instead of building out their own validator sets. EigenLayer aims to create a restaking marketplace, where protocols can buy pooled security from validators, while validators can sell pooled security to protocols.

"One of the central bottlenecks to innovation in today’s crypto ecosystem is the requirement for projects to bootstrap trust, or cryptoeconomic security. We started working on EigenLayer in the hopes of creating a new model in which developers can easily consume trust, instead of needing to build trust, and design powerful systems of assurances that make the crypto ecosystem safer and more useful."

- Sreeram Kannan, Founder and CEO, EigenLayer

How To Restake:

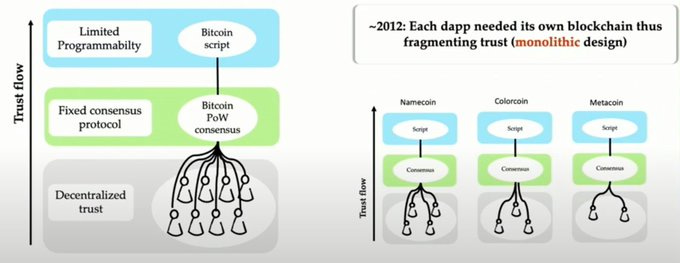

There are multiple restaking methods offered by EigenLayer:

Native Restaking: Validators restake their staked ETH

LSD Restaking: Validators restake assets that are already staked via liquid staking providers, including Lido, Rocket Pool etc.

LSD LP Restaking: Validators restake the LP token of a pair which includes a liquid staking ETH token

ETH LP Restaking: Validators restake the LP token of a pair which includes ETH.

EigenDA :

One of the most prominent use cases of EigenLayer right now is EigenDA, which is a decentralized data availability layer secured by Ethereum. With EigenDA, the gas fees on Layer 2s (L2s) can be reduced significantly. This is made possible because EigenDA is a separate data availability protocol, secured by Ethereum’s security. This is in contrast to existing infrastructure where data availability is in-built into Layer 1s.

Operators can register to the network and begin validating for the first AVS, EigenDA; Restakers can delegate their stake to Operators and start putting shared security to work with EigenDA; and Rollups can integrate with EigenDA to begin experimenting with cost-effective, hyperscale throughput use cases.

Restakers:

As a restaker, you can first restake Native Goerli ETH or LSTs, then directly delegate to the operator of your choice. Operators choose which AVSs to support; when you choose an operator, you are also choosing the AVSs you’d like to support.

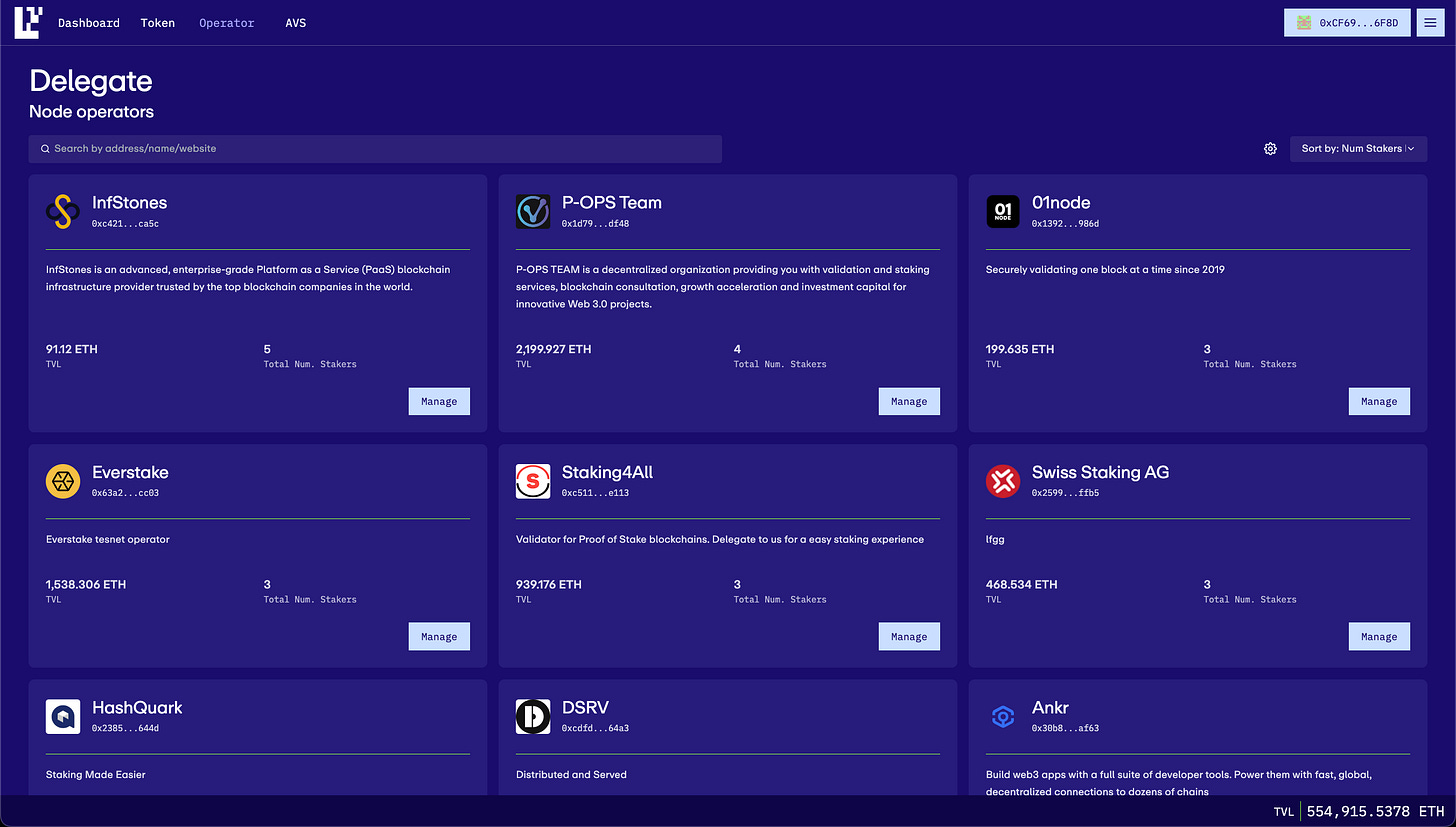

Operators :

As an operator, you can now register on the EigenLayer network via the Operator CLI. Operator registration is permissionless, and we look forward to welcoming all kinds of participants, from solo stakers to large institutions.

AVS Developers :

As an AVS developer, you can explore the first testnet example of an AVS, EigenDA. In addition, we built a demo AVS called Incredible Squaring, which includes sample onchain contracts and offchain node software.

Applications Developed using Eigenlayer :

Hyperscale Data Availability Layer (Hyperscale AVS):

We can build a hyperscale Data Availability (DA) layer providing a high DA rate and low cost by utilizing EigenLayer restaking and some of the cutting edge ideas in DA developed in the Ethereum community, including Danksharding.

Decentralized Sequencers (Lightweight / hyperscale AVS):

Many rollups require decentralized sequencers for managing their own MEV and censorship resistance. These sequencers can be built on EigenLayer with a quorum of ETH stakers — there can be a single decentralized sequencer quorum that performs the service for many rollups.

Light-Node Bridges (Lightweight AVS):

It is easy to build light-node bridges to Ethereum using EigenLayer. For example, the Rainbow Bridge between NEAR and Ethereum is based on an optimistic pattern but experiences high latency due to the high gas cost of verification

Fast-Mode Bridges for Rollups (Lightweight AVS):

For ZK rollups, since the proof verification expense on Ethereum is still high, rollup sequencers write to Ethereum somewhat infrequently, affecting composability and delaying confirmation guarantees. It is possible for a quorum of operators on EigenLayer with a large amount of ETH restaked to participate in ZK proof verification off-chain, and to certify that proofs are correct on-chain.

Oracles (Lightweight AVS):

There have been proposals for enshrining price feeds into Ethereum, or using the Uniswap token quorum for providing price feeds . Such oracles can potentially be built via Eigenlayer if all we require is majority trust on ETH restaked with EigenLayer, and it is an opt-in layer.